Fixed Vs. Variable Mortgage Rates

Table of Contents

How to Determine What Type of Mortgage Rate is Best for You

Whether you are buying your first home or preparing to refinance, it’s important to have an understanding of the different types of mortgage rates when shopping around.

To help give you a better sense of the two types of mortgage rates and how to choose which one is best, we will compare both fixed and variable rates by explaining what each one is along with their respective pros and cons.

Because while there are many other mortgage characteristics you’ll need to choose from (amortization, mortgage term, etc.), your first step when shopping for a mortgage should be to decide which type of mortgage rate is best for you.

With that being said, let’s get into it.

What is a Fixed Mortgage Rate?

One of the most popular mortgage options, a fixed-rate mortgage has your interest rate remain the same throughout the entire duration of your mortgage term.

The most common length for mortgage terms for fixed rates are 3 or 5 years, however, that can also be set for almost any term length from 1 to 10 years .

A fixed rate mortgage has a guaranteed rate for the duration of your contract. Due to the rate being stable during the term, it means the payments are also guaranteed and will not change. This product type easily allows you to project the principal and interest that will be paid over the years of your term. The only way this will change is if you choose to pay extra towards your mortgage by increasing your payments or making lump sum payments.

Pros and Cons of Fixed Rates

The main disadvantage of having a fixed-rate mortgage is that you won’t benefit from lower payments if interest rates start to dip. However, this can also be an advantage, as it means more predictability when it comes to your monthly payments and that you never have to worry about payments increasing during your term.

One way you can still benefit from lower payments when interest rates are low is signing on for a shorter mortgage term. This means you have the stability of a fixed rate, but with the freedom to refinance much sooner and shop around for a better rate.

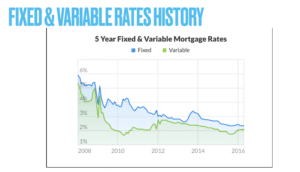

Another downside to having a fixed-rate mortgage is that the historical data shows interest rates tend to be higher than a variable rate mortgage.

Furthermore, breaking a fixed rate with a bank can be very costly. The formula is called the greater of an interest rate differential, or three months’ interest. However, the penalty is almost always the IRD. Bank IRDs make it so the penalty is often somewhere in the range of 2% to 4% of the balance of the mortgage. The IRD for a mortgage company is often close to 1% of the loan amount but can vary as well.

What is a Variable Rate?

A variable mortgage rate is exactly what the name suggests in that your interest rate fluctuates throughout your mortgage term based on the prime rate set byyour lender. This means that if the prime rate increases or decreases, your mortgage payments will likely change.

Most lenders’ prime rates tend to be the similar and are determined based on the rate set by the Bank of Canada. However, some lenders, like TD Bank, have a different prime rate than most other lenders.

Pros and Cons of Variable Rates

The main advantage of having a variable interest rate is that your starting rate tends to be much lower than with fixed. Plus, if the prime rate is lowered at any point, your payments will decrease even further.

A downside though, is that your payments can also increase at any time, making it difficult to plan ahead and budget.

Another benefit is that variable rates tend to be much more flexible. For instance, the penalty for breaking a variable mortgage tends to be more reasonable compared to fixed-rate mortgages. In fact, the penalty to break a variable rate mortgage is a simply three-month interest penalty.

Overall, variable rates offer less stability but make up for it in savings.

Also consider the fact that most lenders will allow you to switch from a variable to a fixed rate during your term with no penalty as long as you take an equal or greater term length. This is a nice benefit of the product. However, keep in mind that if you are changing from a variable to a fixed rate, its likely because rates are on the rise. If rates are on the rise, its likely that you will switch to an even higher fixed rate, so this tactic may not always be beneficial but is a nice perk to know about.

Which One Should You Choose?

This all comes down to a few different factors.

Things to Take into Consideration

- Your income – can you afford payments should interest rates increase? If you are concerned about being able to afford as high as a two percent increase, fixed may be the better option.

- Your lifestyle – Do you crave stability and have a set monthly budget? If you don’t like not knowing if/when your interest rate will go up, you may prefer a fixed rate.

- Your risk tolerance – Are you comfortable taking risks for a potentially high reward? If so, variable could be a good fit.

- Your future plans – Do you plan on selling in the next few years? If so, variable may be the way to go.

- You like having freedom – If you don’t like feeling tied down and want the flexibility to break your mortgage without a significant penalty, variable may work best for you.

Also take a look at mortgage trends to help you make a decision (see chart below). A variable rate mortgage is ideal when rates have been steadily low. But if rates have been on the rise, then fixed could be better for you.

Overall though, when it comes to savings and flexibility, variable rate mortgages almost always win over time.

Whichever rate you do choose, it’s important to think it over carefully and take into consideration your short-term and long-term needs.

How a Mortgage Broker Can Help

Whether this is your first home purchase or you are simply looking to refinance, it’s important that you don’t try to navigate the waters alone. Working with a mortgage broker will be incredibly beneficial when it comes to obtaining a mortgage and deciding on the best type of mortgage for you.

A mortgage broker will work to find you the best rate while explaining in deeper depth the pros and cons of each option and provide a recommendation based on your needs and lifestyle.

So, if you are at the point where you need to apply for your first mortgage or refinance, start working with a mortgage broker right away to help guide you through this process.

Chris Allard’s experience in the field means he can get you offers with over 50 financial institutions lending in Ottawa. Every lender has many mortgage products they offer, which means Chris and his team will make sure a mortgage caters to your needs while also ensuring you get a competitive rate. Chris Allard is a proud mortgage broker of Smart Debt Mortgages, independently owned and operated. Smart Debt broker #12236.