Why Bank Penalties Are So Expensive and How You Can Save On Breakage Fees

Table of Contents

- 1 Breaking Your Mortgage Can Be Expensive – Here’s How to Save on Fees

- 2 What Are Mortgage Penalties?

- 3 Reasons to Break Your Mortgage

- 4 How Do Banks and Other Lenders Calculate Penalties?

- 5 The Reason Penalties Are So Expensive

- 6 How to Avoid High Penalties

- 7 Myth That Porting A Mortgage Is Free Of Penalties With A Bank

- 8 Interest Rate Calculations

Breaking Your Mortgage Can Be Expensive – Here’s How to Save on Fees

So, you’re considering the idea of breaking your mortgage before your term is up—but the only thing standing in your way is a hefty breakage penalty. There is a lot to consider before you decide if this is the right path for you. Here’s what you should know.

What Are Mortgage Penalties?

Mortgage penalties are the fees your lender charges if you decide to break your mortgage contract early. If your mortgage is closed, there are two penalties you might come up against—3 months interest and Interest Rate Deferential fees.

Reasons to Break Your Mortgage

There are a few good reasons you might want to break a mortgage early. The first one is if your financial situation has changed. If you are no longer able to afford what you once were, you might want to consider downsizing and breaking your mortgage. If interest rates have gone down you might also consider it, as it could lead to more savings in the long run than the breakage fee cost. If you find a new job or have to move to a different area for any reason you might need to break it as well.

Additional situations where you may need to break your mortgage early include:

- Switching your mortgage mid-term to benefit from a lower rates and overall savings

- Increasing your loan amount to consolidate debt

- Increasing your loan amount to borrow and invest in something else

- Selling your home and not buying another home right away

- Divorce or spousal separation where equity must be taken out to share the equity among both partners

How Do Banks and Other Lenders Calculate Penalties?

Three Months Interest

The standard interest rate for breaking a fixed mortgage is calculated at three months interest. Meaning a $300,000 mortgage at 3 percent would be $9,000 a year, and divide that by four to get the final number – $2,250.

Interest Rate Differential

Interest Rate Differentials (commonly known as IRDs) ensure that the bank doesn’t lose money on your mortgage. When interest rates drop—say from 5 percent to 2 percent, you may want to break your mortgage to refinance at the lower rate. But you signed a contract to pay them that amount of money, and they owe someone else based off of what you were paying them. If your rate was 4 percent they are likely paying someone else 2.5 percent—so naturally they will charge you if you want to get out of it early.

The Reason Penalties Are So Expensive

Penalties have to be expensive so people are less inclined to break them on a whim. Banks lose profit when a mortgage is broken, so it is in their best interest to make it as unappealing as possible for you to break it early. Whatever they might lose out on you breaking it early, they seek to gain back in penalties.

How to Avoid High Penalties

Get Variable Rate Or A Short Term Fixed Rate

Rather than a long-term fixed rate mortgage, consider going with a variable mortgage. A closed variable mortgage might only end up costing you the 3 month’s interest penalty to break, so it offers the most appealing exit package should you need to break with it early. A short-term fixed rate may also have less penalties than a long-term. If you must do a long term, consider going with a non-bank lender, and make sure you understand how your lender ports. If your mortgage is with a lender that doesn’t port outside of your area and you decide to move to a different part of the country, that could cost you more in fees.

Pre-Payment

If you really want to save on fees, you may want to consider prepayment. If you know you might end up having to break your mortgage early, look into how much your lender allows you to prepay each year and be sure to contribute that amount. It can be anywhere from 10 to 20 percent.

Shop Around

When you are shopping for mortgage lenders, make sure you shop around and consider the fine print before you commit. If you know there’s a chance you might have to break the mortgage early, make sure to ask your lender or mortgage broker in detail about the specific breakage fees and exactly how they are calculated. Your mortgage broker can help you find a lender that allows for the best deal should you have to break it. Use a mortgage broker you trust to help you calculate all the possible fee outcomes.

Look at Smaller Lenders

The best deals tend to come from smaller lenders, so make sure you are exploring all possible options before you sign anything. While the big banks might seem easier, they often have the highest penalties.

The key to ensuring the penalties you pay are low comes before you even sign your mortgage contract, so be sure to do the work ahead of time in case you end up needing to break it unexpectedly.

When choosing a mortgage, we spend a lot of time comparing the pros and cons between banks, credit unions, and mortgage companies. While all three types of lenders use the same formula, which is the greater of 3 months of interest or an Interest rate differential, the various lenders use different numbers within the formula. For example, banks compare the posted rate at the time you got your mortgage to the posted rate closest to the term remaining on your mortgage. Whereas most mortgage companies will use the discounted rate at the time you got your mortgage compared to the discounted rates offered today. Generally, the spread from posted to posted is significantly more than discount to discount. Therefore, the bank penalty for breaking a fixed rate mortgage is generally 2 times to 4 times larger than breaking a fixed rate mortgage with a mortgage company.

Banks used to charge penalties to cover their cost of losing the business, but now, the banks have shifted their mindset to using the IRD calculation as a profitability and retention tool. By contrast, the mortgage companies are much more flexible and are not using the IRD calculation as a retention tool.

Myth That Porting A Mortgage Is Free Of Penalties With A Bank

In many cases, if you are selling to buy another property, you can avoid paying a penalty by porting a mortgage. However, that does not mean you are escaping all cost. if you are porting your 300k mortgage to a new property and you need an extra 100k loan because you are buying a more expensive home, then the existing lender will charge you a new rate on the new money. If the penalty to break the existing mortgage is very large, then the lender has no incentive to give you competitive rate pricing on the new money because they know it is not in your best interest to break the existing mortgage contract. On the flip side, if your mortgage penalty to break your mortgage is small, then the lender must be competitive on the interest rate of the new money, or else you would simply pay your penalty and restart fresh with an entirely new lender. In short, banks use the penalty calculation as a profitability tool and/or as a retention tool, whereas mortgage companies are simply trying to recoup some of their cost for the lost business.

Interest Rate Calculations

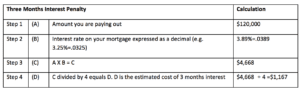

Three Months Interest Calculation

A three-month interest penalty is calculated by applying the interest being charged on your existing mortgage to the principal balance for three months.

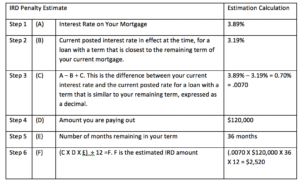

Interest Rate Differential (IRD) Calculation

IRD is determined by calculating the difference between your current interest rate and your lender’s current posted interest rate for the term that is closest to the length of time that is remaining in your term. The difference is then multiplied by the mortgage balance and term.

See the below example:

Chris Allard’s experience in the field means he can get you offers with over 50 financial institutions lending in Ottawa. Every lender has many mortgage products they offer, which means Chris and his team will make sure a mortgage caters to your needs while also ensuring you get a competitive rate. Chris Allard is a proud mortgage broker of Smart Debt Mortgages, independently owned and operated. Smart Debt broker #12236.