Why Bank Penalties Are So Expensive and How You Can Save On Breakage Fees

Breaking a mortgage before the end of your term can come with a surprisingly high cost. Many homeowners only discover how expensive mortgage penalties are when they’re already facing a move, refinancing decision, or life change that forces their hand.

Understanding why these penalties exist and how lenders calculate them puts you in a much stronger position to avoid unnecessary costs before you ever sign a mortgage contract.

Table of Contents

- 1 What You Need to Know About Mortgage Penalties

- 2 What Are Mortgage Penalties?

- 3 Why Would Someone Break a Mortgage Early?

- 4 How Do Banks and Other Lenders Calculate Mortgage Penalties?

- 5 Why Are Bank Mortgage Penalties So Expensive?

- 6 How Can You Reduce or Avoid High Mortgage Penalties?

- 7 Is Porting a Mortgage Really Penalty-Free?

- 8 Why Mortgage Planning Matters More Than the Rate

What You Need to Know About Mortgage Penalties

- Mortgage penalties are designed to protect lender profits, not borrower flexibility

- Banks often calculate penalties in ways that significantly increase costs

- Non-bank lenders typically use more borrower-friendly calculations

- The structure of your mortgage matters more than your interest rate alone

- Planning ahead is the most effective way to reduce breakage fees

What Are Mortgage Penalties?

Mortgage penalties are fees charged by lenders when you break a closed mortgage before the end of its term. These penalties compensate the lender for the interest income they expected to earn over the remaining term of your mortgage.

The Two Most Common Penalties

Most closed mortgages use one of two penalty methods, and you are charged whichever amount is higher:

- Three months’ interest

- Interest Rate Differential (IRD)

Which one applies (and how expensive it becomes) depends heavily on the type of lender and the fine print in your contract.

Why Would Someone Break a Mortgage Early?

Breaking a mortgage is rarely a casual decision. In most cases, it’s triggered by a meaningful financial or life change. Common reasons include:

- Selling a home without immediately buying another

- Refinancing to access equity

- Consolidating high-interest debt

- Relocating for work

- Divorce or separation

- Taking advantage of significantly lower interest rates

In many of these situations, borrowers don’t have the luxury of waiting until their term ends.

How Do Banks and Other Lenders Calculate Mortgage Penalties?

While banks, credit unions, and mortgage companies often reference the same formulas, they do not use the same inputs, and that difference can dramatically impact the final penalty.

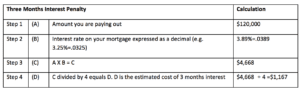

Three Months’ Interest

This penalty is straightforward and is generally considered the less expensive of the two options. It’s more commonly associated with variable-rate mortgages and some shorter-term products.

Calculation

A three-month interest penalty is calculated by applying the interest charged on your existing mortgage to your principal balance over three months.

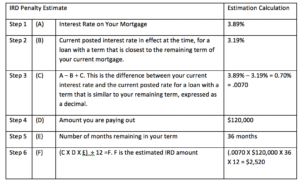

Interest Rate Differential (IRD)

The IRD is where penalties can escalate quickly. Banks calculate IRD using posted rates rather than discounted rates, which creates a much wider gap and therefore a much higher penalty.

In contrast, most mortgage companies calculate IRD using discounted rates, resulting in significantly lower costs for borrowers.

Calculation

IRD is determined by calculating the difference between your current interest rate and your lender’s current posted interest rate for the term that is closest to the length of time that is remaining in your term. The difference is then multiplied by the mortgage balance and term.

Why Are Bank Mortgage Penalties So Expensive?

Mortgage penalties are expensive because they are tied to a profit-and-retention strategy for the financial institution. Consider that:

- High penalties discourage borrowers from refinancing elsewhere

- Borrowers with large penalties have less negotiating power

- Banks can offer less competitive rates on new funds when porting

Over time, banks have shifted from using penalties strictly as cost recovery to using them as a way to retain clients and protect profitability.

Mortgage companies, by comparison, typically aim only to recover reasonable losses rather than restrict borrower mobility.

How Can You Reduce or Avoid High Mortgage Penalties?

The most effective way to reduce high mortgage penalties happens before you sign your mortgage, not after.

Choose the Right Mortgage Structure

- Variable-rate mortgages often come with lower breakage costs

- Shorter-term fixed rates reduce long-term exposure

- Non-bank lenders generally offer more flexible penalty calculations

Use Prepayment Privileges Strategically

If your lender allows annual prepayments, using them can reduce your outstanding balance and, in turn, the size of any future penalty.

Shop Beyond the Big Banks

While banks may feel familiar, they often carry the highest penalties. Exploring credit unions and mortgage companies can lead to far more borrower-friendly outcomes.

A trusted mortgage broker can compare penalty clauses across lenders; something rate comparisons alone won’t reveal.

Is Porting a Mortgage Really Penalty-Free?

Porting a mortgage can avoid a penalty in some cases, but it does not mean the transaction is cost-neutral. Here are some details that might get missed:

- New funds are typically priced at current rates

- Lenders may offer uncompetitive rates if penalties are high

- Large penalties reduce your leverage to negotiate

In practice, lenders know when it’s not in your financial interest to leave and they price accordingly.

Why Mortgage Planning Matters More Than the Rate

When choosing a mortgage, most people focus on interest rates. In reality, penalty structure often has a greater financial impact over the life of the loan.

From experience, borrowers who understand how penalties work and choose lenders accordingly maintain far more flexibility when life changes unexpectedly.

Before committing to any mortgage, it’s worth reviewing penalty clauses with a professional who can explain how they work in real-world scenarios, not just on paper.

If you have questions about mortgage penalties or want help structuring a mortgage with flexibility in mind, the Chris Allard team is here to help.

Contact us today to explore your options.

Chris Allard’s experience in the field means he can get you offers with over 50 financial institutions lending in Ottawa. Every lender has many mortgage products they offer, which means Chris and his team will make sure a mortgage caters to your needs while also ensuring you get a competitive rate. Chris Allard is a proud mortgage broker of Smart Debt Mortgages, independently owned and operated. Smart Debt broker #12236.